Big Week Ahead for Markets

US500

-1.54%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CAT

-1.44%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GS

-1.67%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IBM

-1.48%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

VIX

+8.34%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

VVIX

+5.85%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SKEWX

+7.97%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

It will be a big week, with a ton of economic data ramping up on Tuesday and then going into overdrive on Wednesday. Jay Powell will highlight the week on Nov. 30 at 1:30 PM ET.

I can’t imagine him being dovish, especially after reading through the Fed minutes last week. Based on those minutes, rates will be heading higher, and he will not lock himself into anything, especially with the CPI report due the day before the December rate announcement.

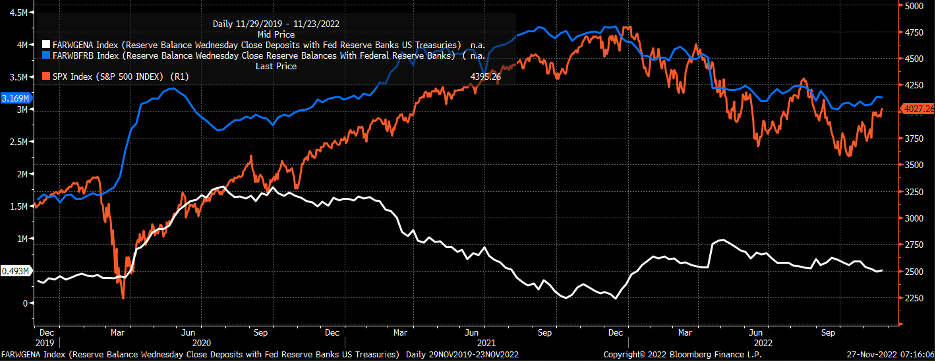

The other problem facing stocks is that the reserve balances stopped rising last week, and the Treasury only has a few weeks left to get the Treasury General Account up the $700 billion it has indicated it wants the account at by year-end. That means the TGA needs to rise by around $200 billion, which will drain liquidity off reserve balances. If that happens, reserves will probably fall back to their October lows, which was also in line with the S&P 500 lows.

FARWGENA Index Chart

FARWGENA Index Chart

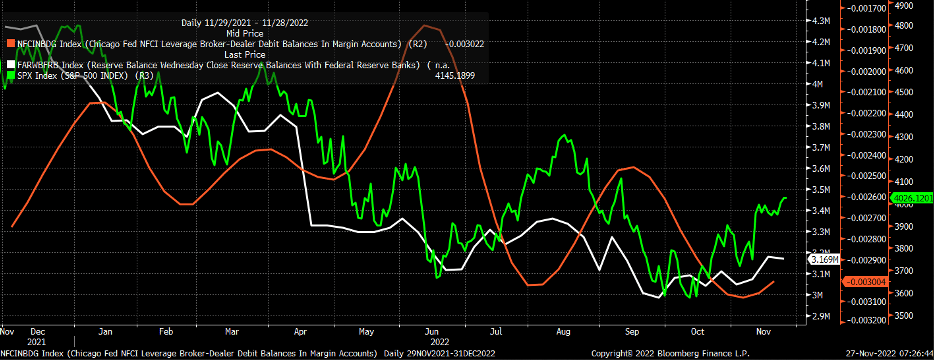

The other problem for the market is that financial conditions for margin are again tightening. Rising reserve balances and easing financial conditions for margin have given stocks a powerful boost as they did in March and August. But if margin conditions continue to tighten and reserve balances drop, a lot of liquidity will be sucked out of the market between now and year-end. This has been a liquidity fuel market since the March 2020 lows, both up and down.

Margins

Margins

SKEW

On top of that, we know Powell wants overall financial conditions to tighten, which will be a headwind. It is tough for me to be bullish going into year-end knowing all of these things. On top of that, we are seeing traders starting to think about tail risk again. The SKEW index had a big move higher last week.

CBOE SKEW Index Daily Chart

CBOE SKEW Index Daily Chart

VVIX

It couldn’t be a better time for traders to think about tail risk again, as hedging is now cheaper than at any point in the past year. The VVIX is near its lows and is also starting to creep higher. Suggesting that the implied volatility of the VIX is on the rise, and the more it rises, the more expensive it will be to put hedges in place. Thus, you are starting to see that process play out with the SKEW Index as traders reach for cheap out of the money protection.

VVIX Daily Chart

VVIX Daily Chart

VIX

On top of that, we see that the spread between the spot VIX index and the 3-month generic VIX futures contracts is now -5.33. Historically, when that spread has gotten below -5, it has been associated with tops in the S&P 500, and that is where we are now.

VIX Chart

VIX Chart

S&P 500

Additionally, this still looks like nothing more than a corrective pattern in the S&P 500.

SP 500 Futures Hourly Chart

SP 500 Futures Hourly Chart

Also, there is still a diamond reversal pattern that is in the S&P 500 at this point, and the index is built on an unstable pattern. I still think the index is going to fill the gap at 3750 and potentially drop back to 3,600 if the TGA rises, as I expect.

S&P 500 Index Hourly Chart

S&P 500 Index Hourly Chart

IBM

International Business Machines (NYSE:IBM) has continued to rocket higher, and that rally appears to be nearing its end. The stock is forming a rising wedge, which tends to be a reversal pattern. It also has gaps to fill down to $146.75, $137.25, and $134.90 over the short term.

IBM Hourly Chart

IBM Hourly Chart

Goldman Sachs

Goldman Sachs (NYSE:GS) may also be near a reversal, with a potential diamond reversal similar to the S&P 500. The RSI is starting to slow and also appears to be rolling over. Again, we will see what happens here, but the stock has rocketed higher in what appears to be a rotation out of technology to some of these cheaper valuation names.

Goldman Sachs Group Inc Daily Chart

Goldman Sachs Group Inc Daily Chart

Caterpillar

Caterpillar (NYSE:CAT) shares have raced higher and have nearly eclipsed their all-time highs. The stock is now forming a double top and has an RSI that is diverging lower, suggesting the stock’s rally is running on fumes. It has a gap at $219 that is still yet to be filled, which is the first significant level of support.

Caterpillar Daily Chart

Caterpillar Daily Chart