Dow Jones Ready to Breakout

US500

-0.39%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DJI

-0.13%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2000

-0.71%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

-1.09%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Markets eased back from their weekly highs last week on declining volume, but has been a fairly orderly move lower. Support levels are there for indices to lean on.

The Nasdaq has its 50-day MA alongside its 20-day MA to use as support. The ‘black candlestick’ is typically a bearish one-day candle, but as it’s not positioned as a swing high it carries less weight. Technicals are net positive, although there is a return to underperformance against the S&P 500. An ideal candlestick would be a gravestone ‘doji’ or a bullish hammer as an end point to this decline.

COMPQ Daily Chart

COMPQ Daily Chart

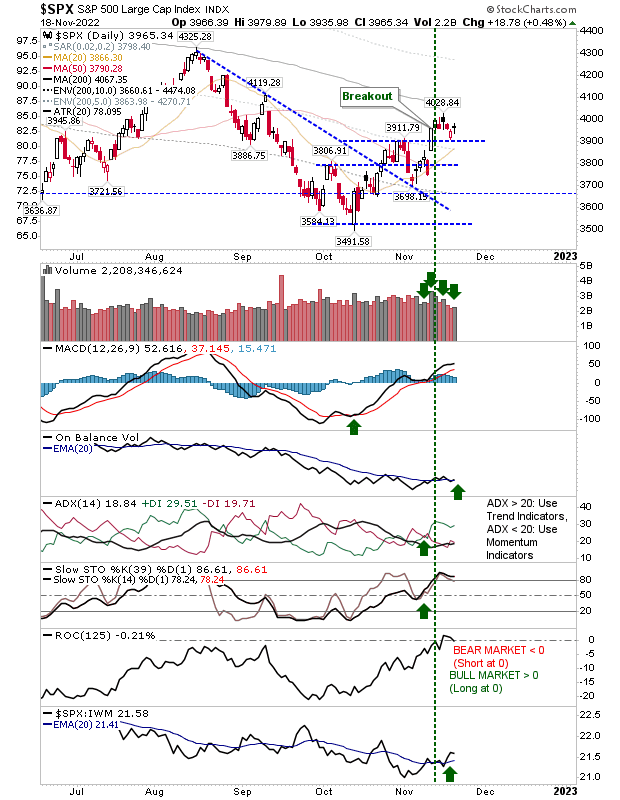

The S&P is lingering just below its 200-day MA and above the October swing high. Volume climbed to register as an accumulation day, and the sequence of recent buying days was enough to generate a ‘buy’ trigger in On-Balance-Volume.

SPX Daily Chart

SPX Daily Chart

The Russell 2000 returned to its 200-day MA, and is running along 20-day MA support. After a strong period of outperformance relative to the Nasdaq the relationship has flat-lined, but other technicals are net bullish. The squeeze of the 200-day and 20-day MAs may be the catalyst for the next move.

IWM Daily Chart

IWM Daily Chart

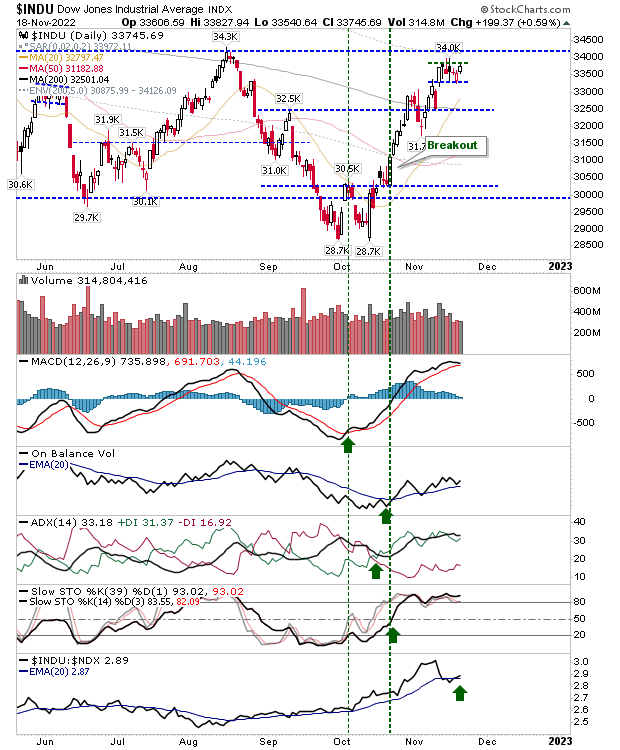

The index which is enjoying the best performance is the Dow Jones Industrial Average. It has shaped a nice handle just below the August swing high and is set up for a significant breakout. Technicals are net bullish with an improving trend in on-balance-volume accumulation.

INDU Daily Chart

INDU Daily Chart

In the grand scheme of things, Friday’s action was generally positive. The Dow Jones Industrial Average looks like it will lead the indices out and I would be looking for the S&P to soon follow suit.