Euro on Hold Ahead of Eurozone CPI

EUR/USD

+0.93%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

It has been a busy week for EUR/USD, although the currency is unchanged on Friday. We could see some volatility before the weekend, with the release of the eurozone inflation and US employment reports.

Eurozone CPI Expected to Fall

Market participants and ECB policymakers are eagerly awaiting December’s eurozone inflation report. Germany, France, Italy, and Spain all recorded a drop in December inflation, with German inflation slowing to 9.6%, down from 11.3% in November. The eurozone should follow this downtrend, and the forecast is for headline CPI to fall to 9.7%, compared to 10.1% in November. An important caveat is that inflation dropped in Germany and other bloc members due to government energy subsidies, and ECB President Lagarde has acknowledged that inflation could rebound once the subsidies come to an end. The real test will be the core rate, which excludes energy and other volatile components. Core CPI has been sticky and is expected to remain unchanged at 5.0%.

The ECB was late to the rate-tightening party and has had to tighten aggressively despite weak economic conditions in the eurozone. The central bank eased the pace of rates to 50 bp in December, down from 75 bp in October, but Lagarde warned that this should not be interpreted as a dovish pivot and added that more rate hikes were coming. The markets have priced in a 50-bp hike at the February 2nd meeting, although the ECB could change its mind, say to a 25-bp increase if warranted by key economic data.

In the US, the week wraps up with the employment report, highlighted by nonfarm payrolls and wage growth. Unemployment claims and other employment indicators show that the labor market remains strong, despite a slowing economy. The ADP employment report, although not considered a reliable precursor to NFP, jumped to 235,000 in December, crushing the previous reading of 127,000 and the estimate of 150,000. An increase in the NFP would be a major surprise, as the consensus stands at 200,000, down from 263,000 in November.

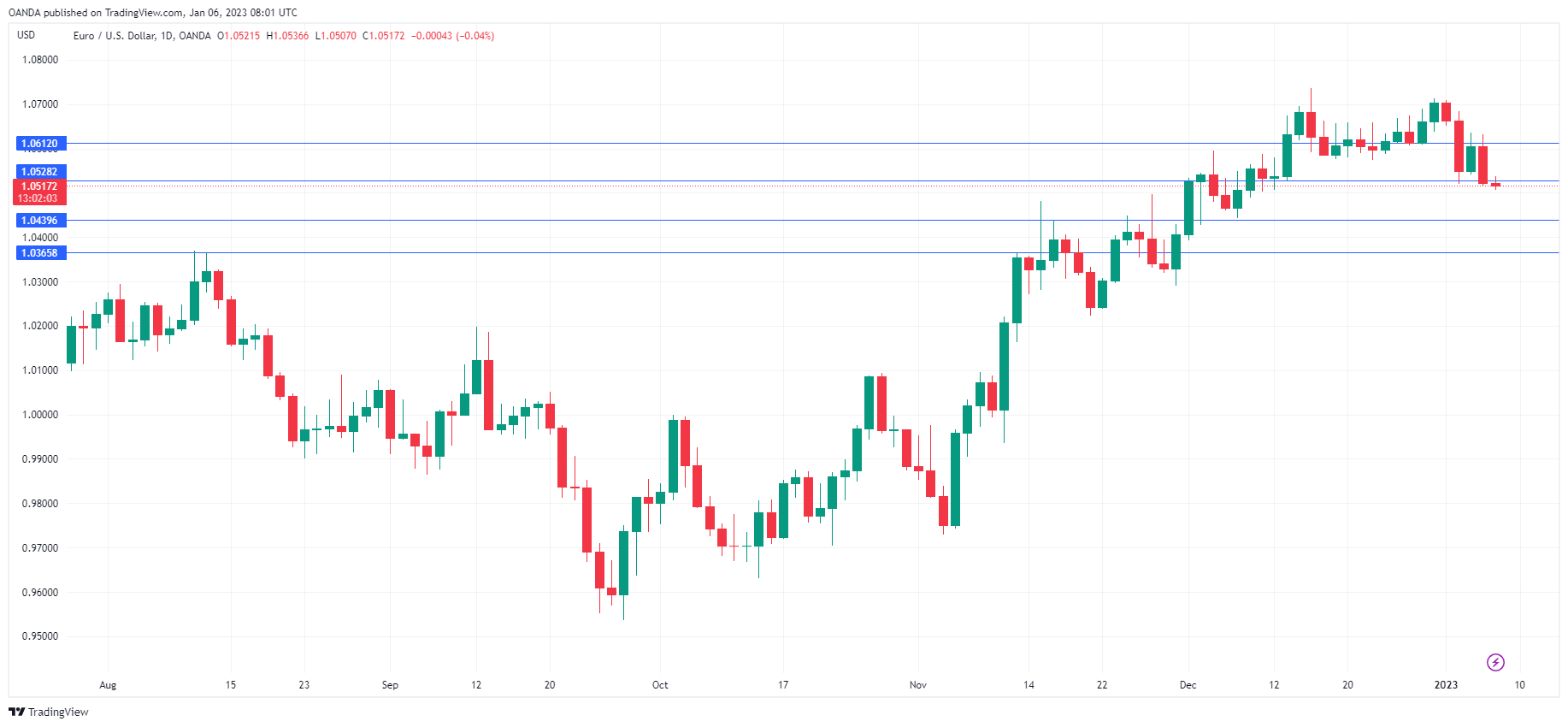

EUR/USD Daily Chart

EUR/USD Daily Chart

EUR/USD Technical

- EUR/USD tested resistance at 1.0528 earlier in the day. This is followed by resistance at 1.0612

- There is support at 1.0440 and 1.0365