Silver Bulls Roar Back; Meet Key Resistance

Silver_daily_chart_01_12

Silver_daily_chart_01_12

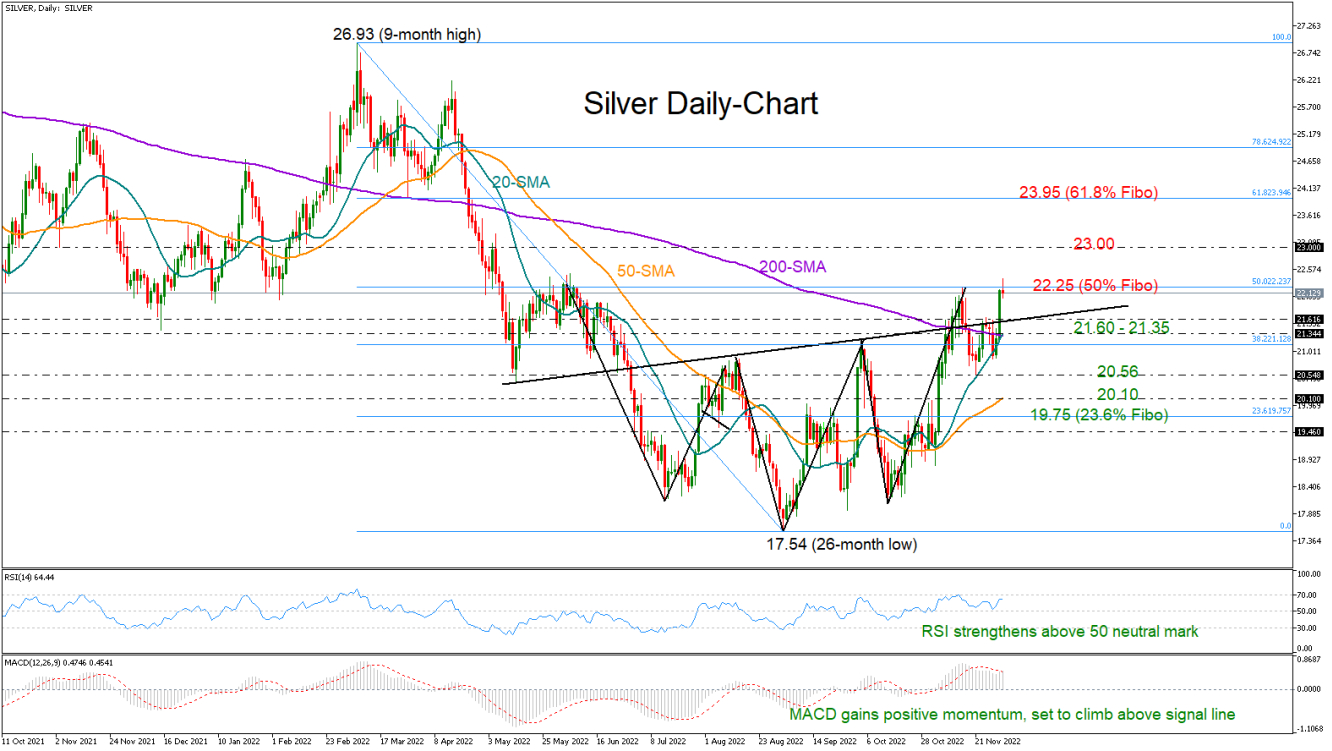

Silver staged an exciting rally to re-enter the 22.00 region on the back of Powell’s dovish tone on Wednesday.

The 50% Fibonacci retracement of the 26.93-17.54 downtrend at 22.25 is again under the spotlight, pushing the market back to losses after the pickup to a new high of 22.39 early on Thursday. Yet, the bulls may have some extra fuel in the tank according to the RSI and the MACD. The former has recently recouped some ground above its 50 neutral mark, while the latter keeps gaining positive momentum, currently set to climb above its red signal line.

If the wall at 22.25 collapses, the bulls will gear up for the 23.00 psychological mark. Breaching the latter, the rally could continue towards the 61.8% Fibonacci of 23.95.

In the event of a downside reversal, the price may initially seek support between 21.60 and 21.35, where the 20- and 200-day simple moving averages (SMAs) are placed. The 38.2% Fibonacci of 21.12 may cement that floor, delaying an extension to the previous low of 20.56. Otherwise, the decline could stretch towards the 50-day SMA, bringing the 23.6% Fibonacci of 19.75 in sight too.

In short, silver is currently testing an important resistance region at 22.25, a break of which is required to activate fresh buying.