USD/JPY Lacks Bullish Motives Near November’s Low

USD/JPY

-1.33%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

USDJPY_30_11_daily

USDJPY_30_11_daily

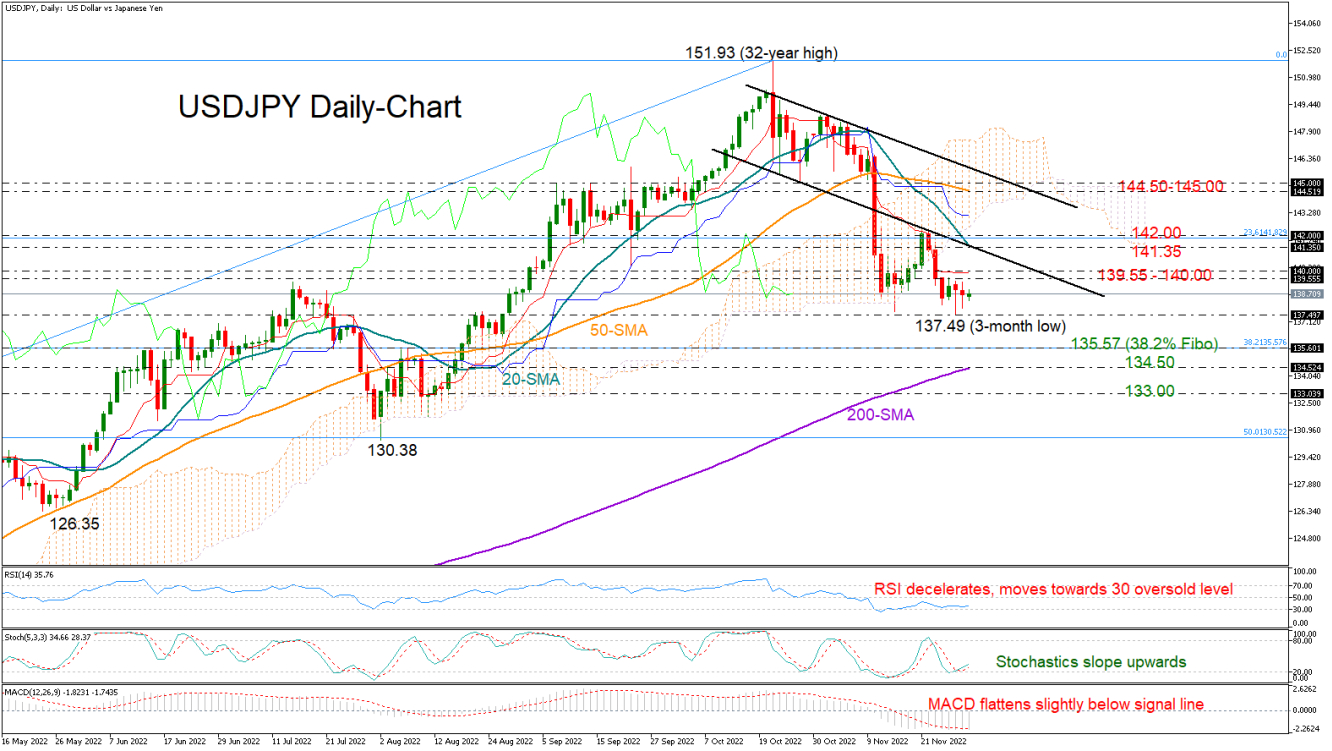

USDJPY shifted to the sidelines following last week’s aggressive downfall from the 142.00 area, consolidating its losses between 139.55 and 137.49.

Even though the pair is searching for a foothold near November’s low of 137.49, the technical signals have yet to identify strong buying motives. Particularly, the RSI has been struggling to gain ground following the exit from the oversold territory, while the MACD has been flattening slightly below its red signal line and within the negative area.

If selling pressures resurface below November’s trough, all eyes will turn to the 38.2% Fibonacci retracement of the 109.10-151.93 uptrend at 135.55. However, the 200-day simple moving average (SMA), which hasn’t been tested since February 2021, could be a more important barrier at 134.50. A decisive close below it could confirm additional losses towards the 133.00 round level.

On the upside, a break above 140.00 is required to boost the price towards the 20-day SMA at 141.35. The channel’s lower boundary is in the same area, while the 23.6% Fibonacci of 141.89 is also within breathing distance. Should the pair re-enter the 142.00 zone, the recovery may speed up to the 50-day SMA at 144.57.

All in all, the ongoing sideways move in USDJPY remains exposed to a breakdown. A step below 137.49 could trigger the next bearish phase in the market.