Bitcoin Breakout Became a Fakeout: What’s Next?

BTC/USD

+5.12%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Two weeks ago, see here, we found for Bitcoin (BTC)

“.”

Fast forward, and BTC’s breakout lasted for only four days after our update, topping at $31024, and dropping a week later back below the critical $27270. Thus the breakout became unfortunately a fakeout, showing one must always be ready for such a possible scenario.

There are no certainties in trading and one doesn’t want to become the bag holder. Instead, one has to recognize as early as possible that the trend is in jeopardy by having objective price levels and a flexible and open mind. Or as they say “”. As such we already informed our premium members of BTC’s failure to hold critical support levels last Wednesday. See here.

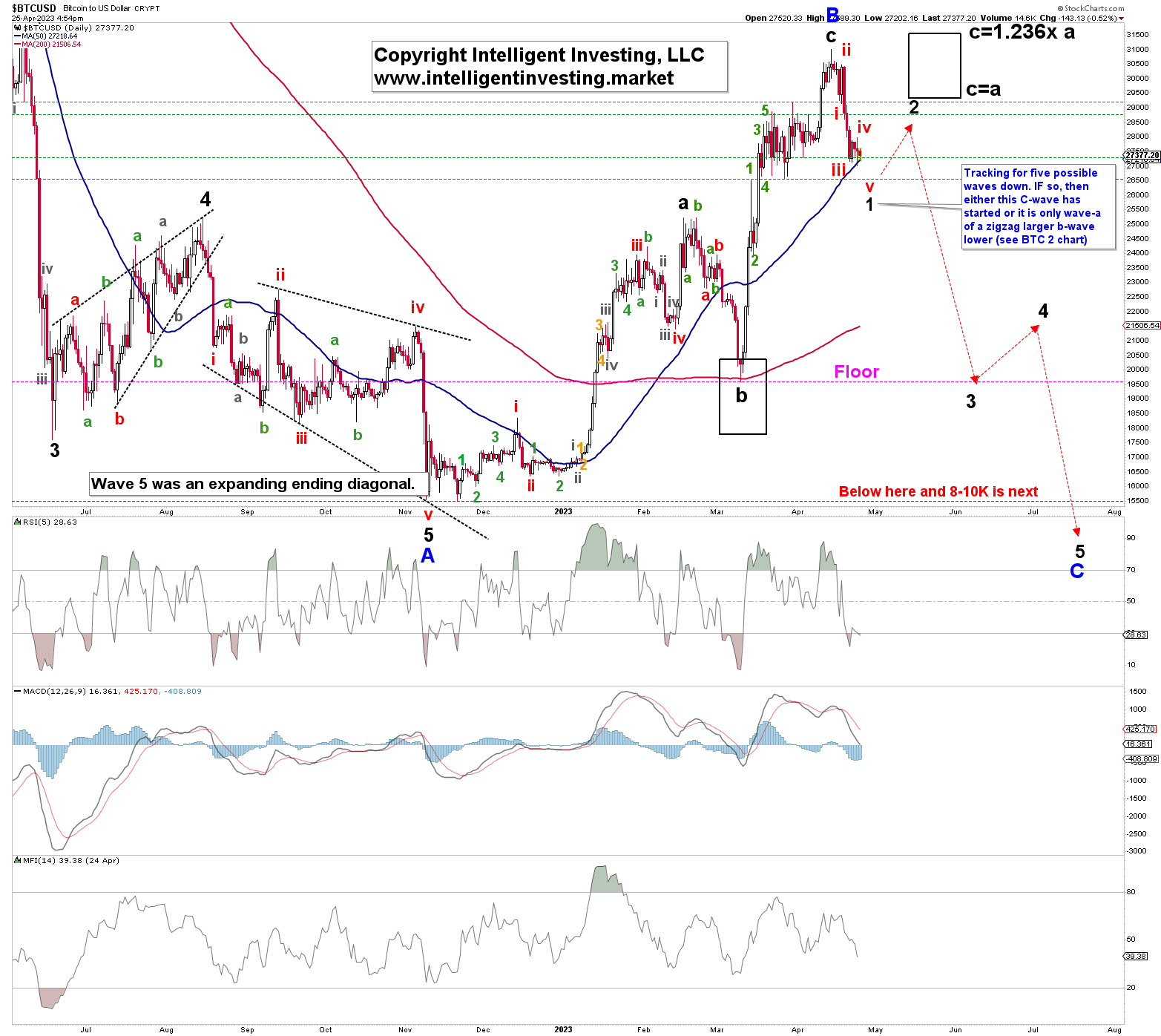

Hence, our intermediate- to long-term Bullish POV on BTC must be adapted accordingly. Figure 1 below shows the adjusted EWP count. What does this mean

Figure 1.

Bitcoin Daily Chart

Bitcoin Daily Chart

At this stage, BTC has only done three larger (black) waves (a-b-c) up from its November 2022 low, which is corrective. Hence why we have always labeled these waves as 1/a, 2/b, and 3/c throughout our updates because one can not know for certain if BTC’s price will do five or only three larger waves up. We track for five but know that if key levels break to the downside that path is invalidated. That is the power and beauty of applying the EWP objectively. Thus, a drop below the November low -per the red-dotted path- should now be our primary expectation until proven otherwise.

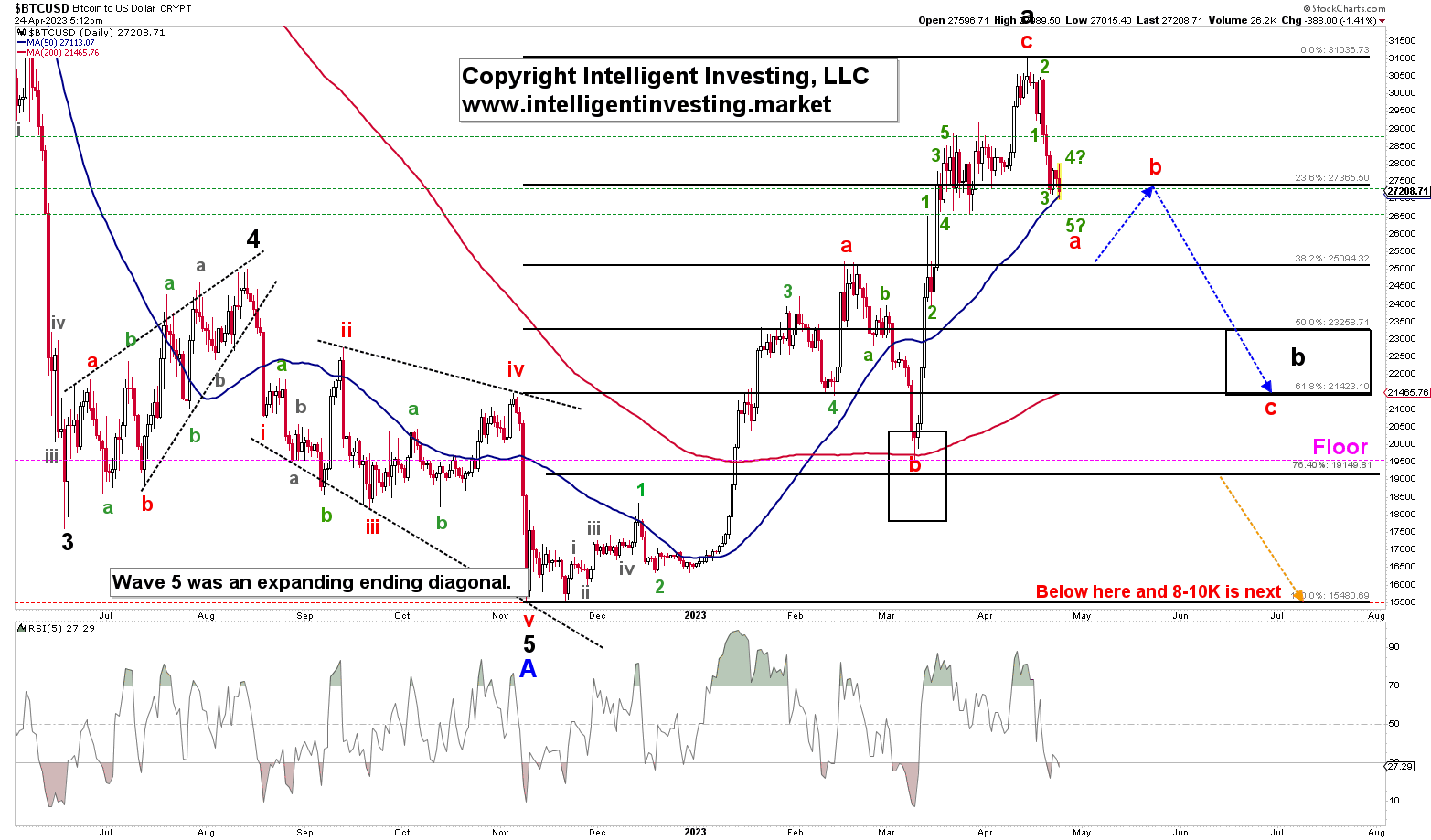

We are also tracking an alternative scenario where the three larger waves up are only black W-a of the larger blue W-B. See Figure 2 below. In that case, the blue arrows outline the rough path we are expecting over the next few weeks to months. Once the black W-b bottoms, another rally should start targeting ideally $37000+. For now, and in either case, we are looking for marginal lower prices for the short term, then a bounce back to resistance followed by -at least- another leg lower.

Figure 2. Bitcoin Daily Chart

Bitcoin Daily Chart