2 Standout Dividend Growth Stocks to Buy and Hold in 2023

NDX

-1.79%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

-1.04%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

MA

-0.27%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AXP

+3.31%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

V

+0.25%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

JBHT

+0.27%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

BRKb

-1.07%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NOBL

-0.77%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

- Fixed-income stocks have outperformed the broader market by a wide margin in the past 12 months.

- I remain positive on companies with growing dividend payouts, strong fundamentals, and high free cash flow amid the current market environment.

- As such, I recommend buying American and J.B. Hunt Transport Services.

Dividend-paying stocks tend to provide investors with a solid income stream, regardless of economic conditions, as the quarterly payouts generally act as a hedge against economic uncertainty, similar to the current market backdrop.

Not surprisingly, defensive-minded value stocks with strong dividends and sound financials have outperformed the broader market by a wide margin in the past year as market players seek safer bets for creating wealth.

Indeed, the ProShares S&P 500 Dividend Aristocrats ETF (NYSE:NOBL) — a measure of companies that have increased their dividends annually for the last 25 years or more — has fallen just 1% over the past 12 months, compared to the S&P 500’s roughly 9% decline. NOBL vs. S&P 500 Price Performance

NOBL vs. S&P 500 Price Performance

As such, I recommend buying shares of American Express (NYSE:AXP), and JB Hunt Transport Services Inc (NASDAQ:JBHT) given their solid fundamentals, healthy balance sheets, and reasonable valuations.

Perhaps of greater importance, both companies have long histories of dividend increases, making them attractive plays during this volatile time in the market.

American Express

- *Year-To-Date Performance: +17.2%

- *Market Cap: $129.3 Billion

Between its attractive valuation, encouraging fundamentals, dependably profitable business model and enormous cash pile, I believe that shares of American Express are a smart buy amid the current market backdrop.

With an abundant amount of cash on hand and relatively low debt, the New York City-based payment processing company has been consistently making efforts to reward its shareholders through higher dividends and stock buybacks.

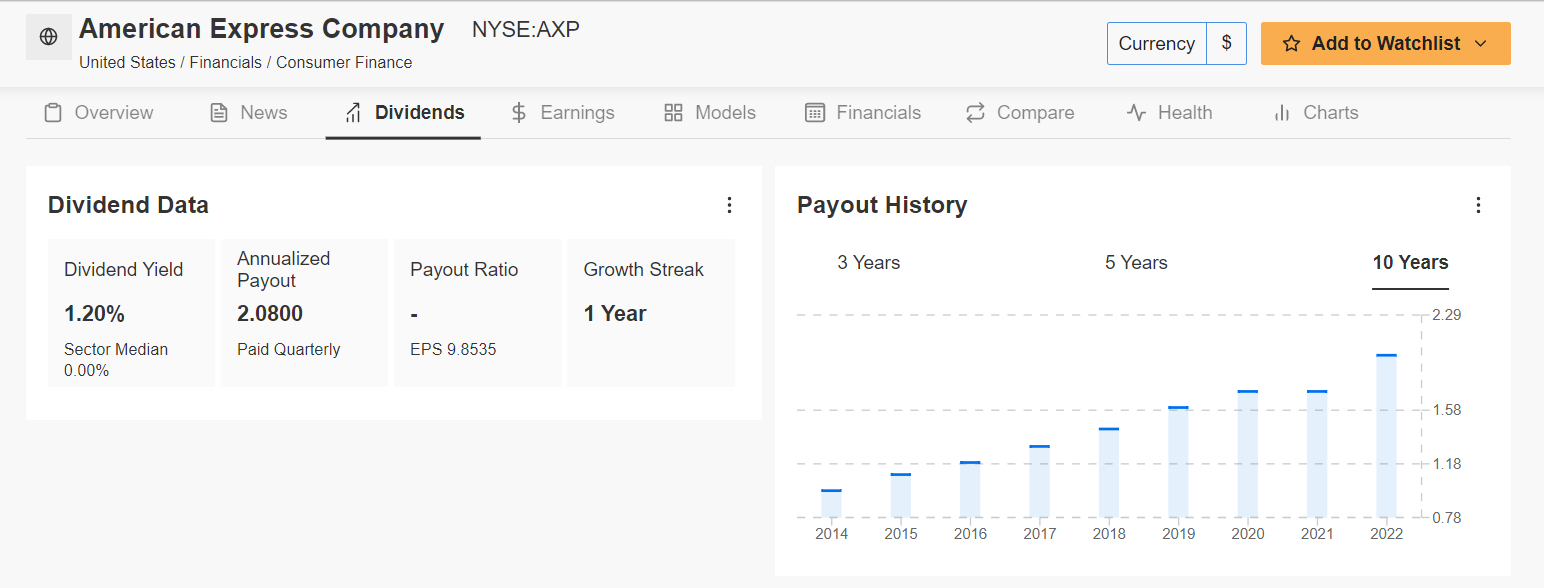

In fact, American Express’s board of directors last month approved a 15% increase in its quarterly cash dividend from $0.52 to $0.60 per share, beginning in the current quarter. The new dividend results in an annualized cash payout of $2.60 per share, up from $2.08 presently, at a yield of 1.20%.

The move reflects the credit card giant’s ongoing commitment toward boosting shareholder value by returning additional capital to investors thanks to its strong balance sheet and expected free cash flow growth.

AXP Dividend Data

AXP Dividend Data

Shares of American Express, one of Warren Buffett’s Berkshire Hathaway’s (NYSE:BRKb) top stock holdings, have gotten off to an impressive start to 2023, surging over 17% thus far to easily outpace the comparable returns of major industry peers Visa (NYSE:V) (+10.5%) and Mastercard (NYSE:MA) (+7.8%) over the same timeframe.

AXP closed at $173.13 last night, within sight of a recent nine-month high of $177.86 reached on Jan. 30. At current valuations, Amex has a market cap of approximately $129.3 billion.

AXP Daily Chart

AXP Daily Chart

Looking ahead, I expect American Express to remain one of the best-performing payments processing names in the market as it remains well placed to deliver steady profit and sales growth due to its formidable credit card business and wide range of financial services.

The company stands to directly benefit from high interest rates, regardless of whether the economy falls into recession or not. Since most credit cards have a variable rate, there’s a direct correlation to the Fed’s benchmark interest rate. As the federal funds rate rises, the prime rate does as well, resulting in higher credit card rates and fees.

Unlike Visa, and Mastercard, American Express is both a card issuer and a card processor, which lets it keep a bigger portion of fees from the transactions it processes.

J.B. Hunt Transport Services

- *Year-To-Date Performance: +13.2%

- *Market Cap: $20.4 Billion

J.B. Hunt Transport Services is one of the biggest transportation and logistics firms in the U.S., currently operating more than 12,000 trucks. The Lowell, Arkansas-based company’s fleet also consists of over 145,000 trailers and containers.

Shares have run hot in recent months, with JBHT stock marking a gain of almost 27% since slumping to a recent low of $156.28 in late September. The stock, which has gained 13.2% so far in 2023, ended Thursday’s session at $197.35, its best level since April 1, 2022.

JBHT Daily Chart

JBHT Daily Chart

Regardless of economic conditions, I expect JBHT’s stock to continue its strong performance in the year ahead as the dividend-paying freight bellwether has proven over time that it can sustain a weakening economy and still provide investors with higher dividend payouts.

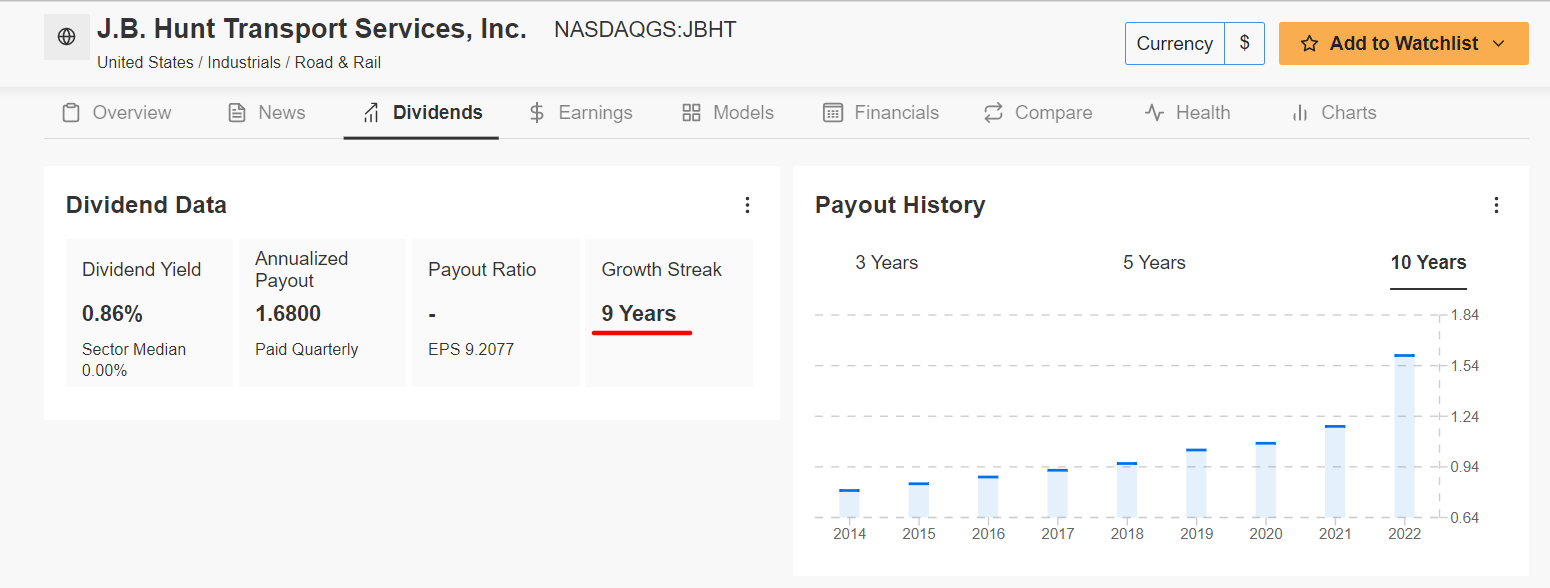

In the latest shareholder-friendly move, J.B. Hunt’s board of directors approved a dividend hike of 5% last month, raising its quarterly cash payout for the ninth straight year. The new dividend of $0.42 per share will be payable on February 24, 2023, to stockholders of record on February 10, 2023, with an ex-dividend date of February 9, 2023.

At current share prices, the annual dividend rate implies a dividend yield of 0.86%, which compares with the implied yield for the S&P 500 of 1.52%. JBHT Dividend Data

JBHT Dividend Data

Supported by its strong liquidity position, the company has returned almost $300 million to shareholders through a combination of cash dividends ($238.7 million) and share buybacks ($55.3 billion) over the past two years, highlighting its focus on investor returns.

The trucking and logistics giant’s fourth-quarter financial results fell short of analysts’ expectations on Jan. 18, however, management said they expect freight demand to improve in the coming months as pandemic-era supply chain constraints continue to fade.

While JBHT executives declined to provide guidance for the rest of 2023, they said they expected that retailers and manufacturers would soon start ordering goods for the summer and fall as companies return to more conventional ordering cycles.

***