Gold to $4000 by 2025?

XAU/USD

+0.03%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Gold

-0.57%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

We have been writing about gold’s super bullish cup and handle pattern and the future breakout for years.

It is coming and with it, a new cyclical and secular bull market.

That aside, I wanted to delve into how and why the gold price should double within the next two and a half years.

Nearly 18 months ago, we wrote about gold’s cup and handle pattern and the historical outcomes of somewhat similar patterns.

One important takeaway from the article and history is some historical cup and handle patterns moved from their measured upside targets to log targets in six to twelve months.

Gold’s measured upside target is $3000, and its log target is anywhere from $3,745 to $4,080 (depending on how you measure).

These targets may seem extreme, but not when considering gold’s performance during secular bull markets.

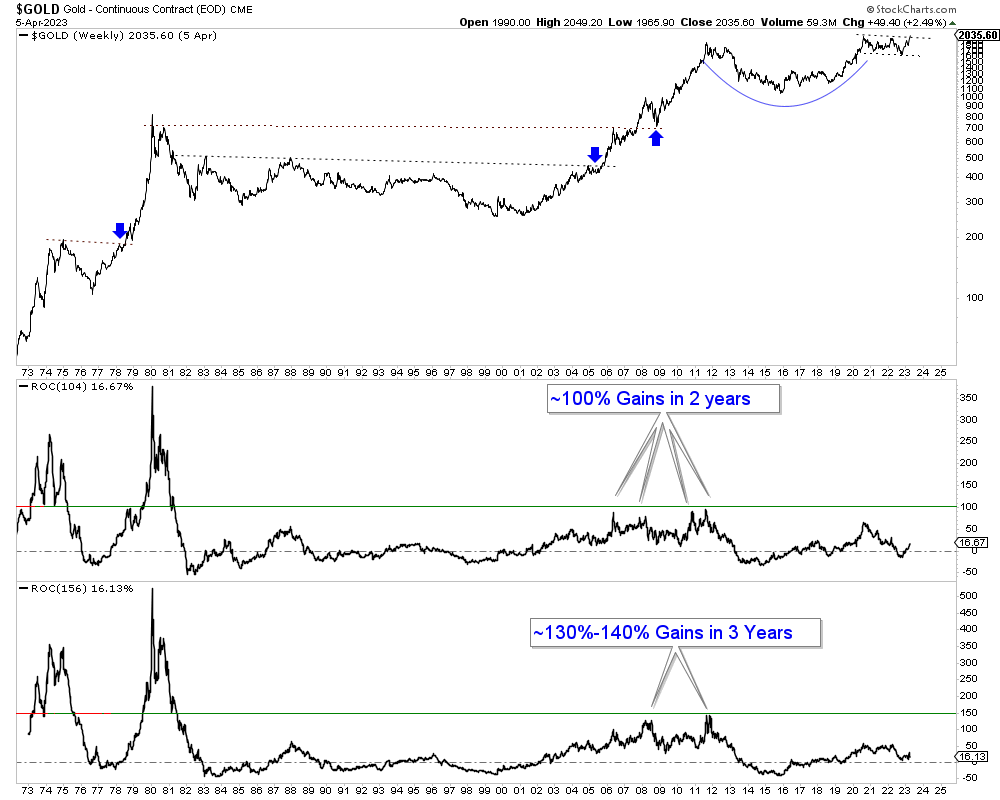

The chart below plots gold and gold’s rolling rate of change over two years and three years.

During the 2000-2011 bull market, gold achieved 130% to 140% gains in three years at two different points. If we take the 2022 weekly low of $1645 and apply a 140% gain over three years, we get $3948 in October 2025.

Gold Long-Term Chart

Gold Long-Term Chart

While breaking out from a multi-decade base (in 2005) and successfully retesting a 28-year breakout (2008) was quite significant, I anticipate breaking out from a 12-year cup and handle pattern to new all-time highs offers greater upside potential.

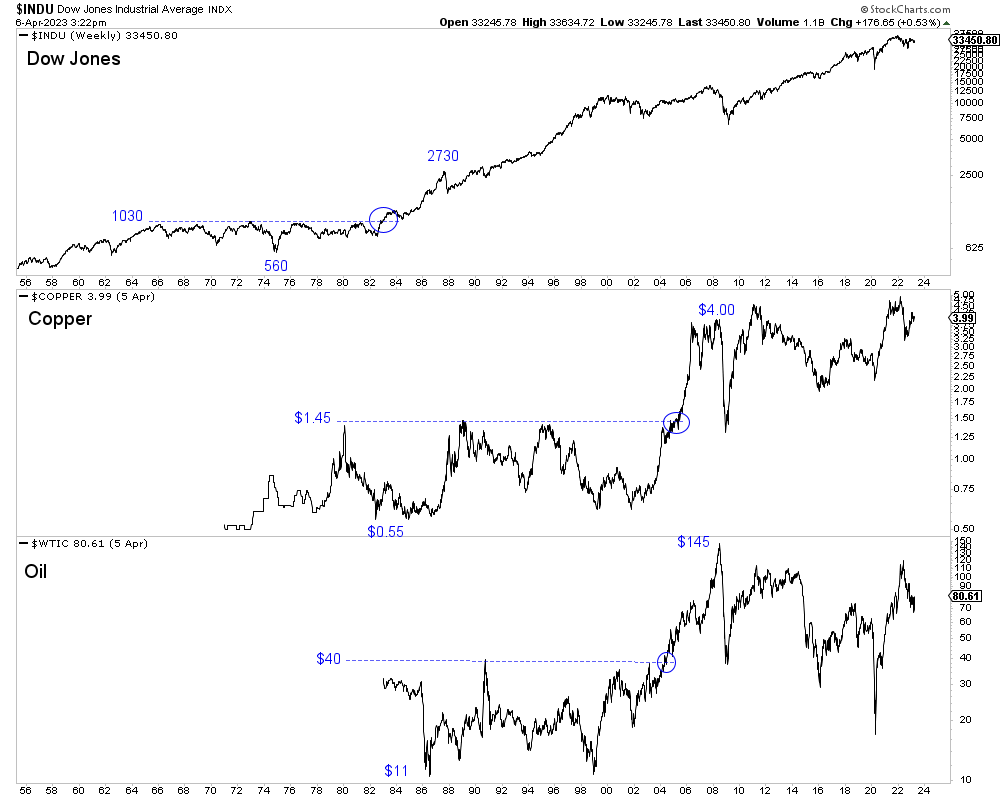

Here are other examples of multi-decade breakouts and how the market performed immediately following the breakout:

- After trading between 560 to 1030, the Dow Jones Industrial Average reached 2730 within five years.

- Copper traded between $0.55 and $1.45 for three decades. Then it surged to nearly $4.00 within two years.

- Oil traded between $11 and $40 for three decades. Then it surged to $140 in four years.

Dow, Copper, WTI Long-Term

Dow, Copper, WTI Long-Term

The initial upside moves following those three breakouts was anywhere from 2.8 to 3.4 times the size of the previous trading range. The moves were much faster in the commodities.

Gold’s impending breakout is not the best comparison, as a cup and handle pattern is different from a breakout from a range. Silver would be a better comparison, but I will get to that in a future article.

If gold were to make a similar move post-breakout, then it would equate to a price of nearly $5000 in 2026 or 2027.

Multiple things are pointing to $4000 in 2025, but my opinion is gold could move towards $5000 before the end of 2026.

We are only in the first inning of what is likely to be an exciting and massively profitable next few years.