Natural Gas at Point of Inflection Amid Season of Injections

NG

+1.34%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

TFMBMc1

-1.59%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

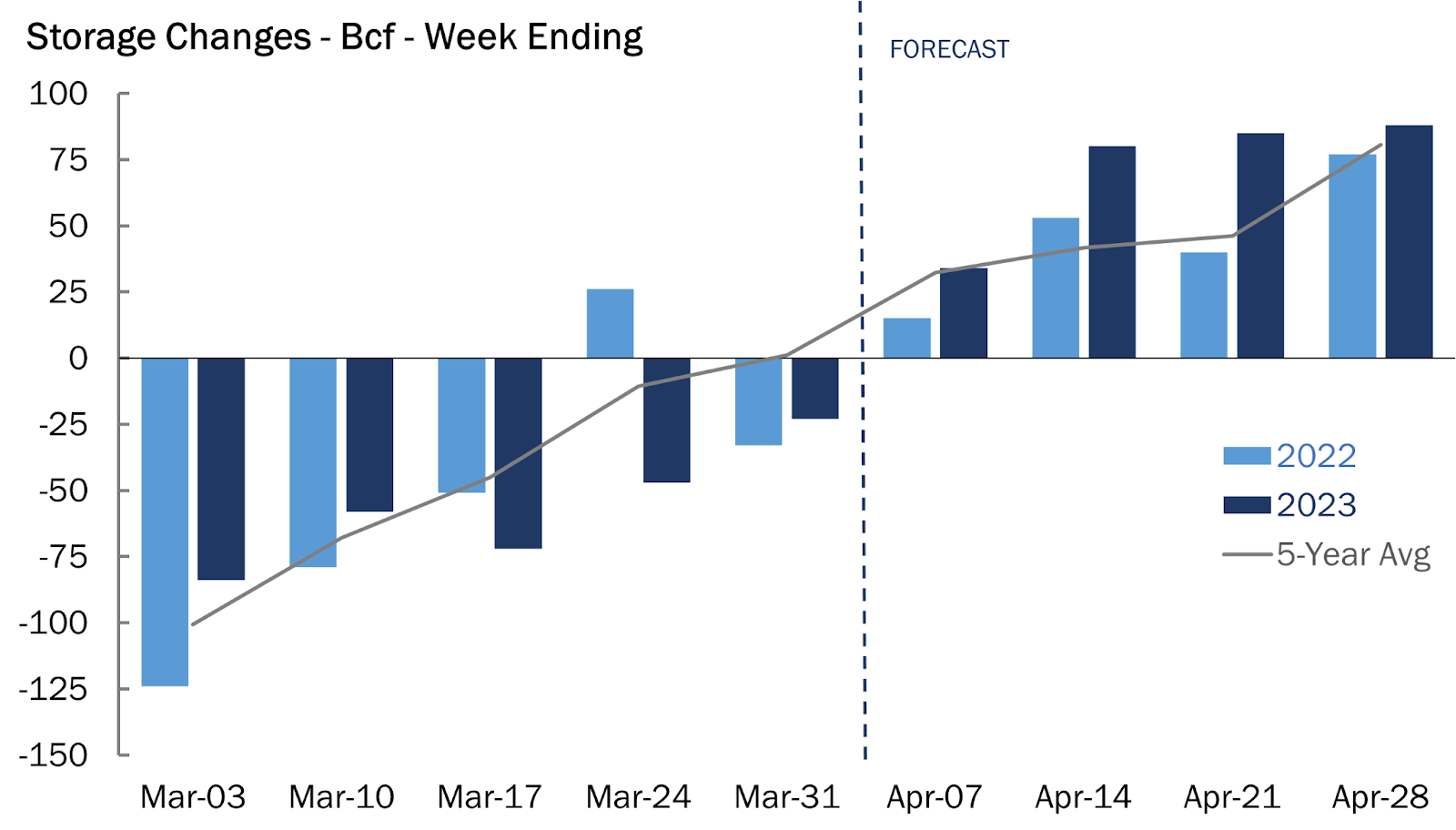

- First gas injection of 2023 likely occurred last week with 28-bcf build

- Spring start to storage one of the most bloated ever, seen at 1.881 tfc

- Charts suggest gas futures could break $2 support again before rebounding

It’s here: The season for natural gas injections, with the first addition to storage for spring likely having occurred last week.

The bet among industry analysts is that some 28 billion cubic feet, or bcf, likely made its way into the underground caverns that act as storage for the gas that utilities burn for power generation and temperature moderation.

The spring injection season for gas arrives before the summer withdrawals necessary for burning the fuel for cooling. Typically, this is a time when storage is at seasonal lows after large and consistent withdrawals during winter when gas is burned for heating.

Not this time, though.

The 2023 pre-summer injection season is starting with one of the most bloated gas storages, courtesy of a winter that ran mostly warm, with one of the fewest snow storms ever.

As of the week ended March 31, gas-in-storage stood at 1.853 trillion cubic feet, or tcf, the Energy Information Administration, or EIA, said in its final inventory reading for March.

That was 31% higher than the gas balance at the same time a year ago and 21% up versus the five-year average, EIA data showed.

In an update due at 10:30 ET (14:30 GMT) today, the EIA is expected to report a stockpile of 1.881 tcf for the first week of April, after accounting for the 28-bcf increase. Natural Gas Storage Changes

Natural Gas Storage Changes

Theoretically, there are few things for gas longs to feel cheery about in the face of the massive storage level.

But some lingering cool weather and issues on the production front could bring some relief to gas bulls as these could offset the amount of fuel that goes into storage each week, reducing the quantum of builds.

As of this week, weather runs shifted slightly cooler in the back half of the forecast period, but not to an unreasonable extent.

Production has also continued to decrease from maintenance-related events.

Gulf Coast Express announced that inspections and planned maintenance of compressors reduced flows and outages and is now saying that these outages will extend through April 15th. The pipeline carries natural gas from the Permian production area to the hub near Agua Dulce, Texas. It also enables exports to Mexico and LNG liquefaction terminals on the Gulf Coast, while meeting the growing demand for industrial customers.

Kinder Morgan’s Permian Highway Pipeline, or PHP asset, meanwhile, requires a valve replacement which has reduced volumes by 0.5 bcf per day. This outage was supposed to be resolved as of Wednesday but has been extended.

PHP is undergoing an expansion project that will increase its capacity by approximately 550 million cubic feet per day. The project will involve primarily additional compression on PHP to increase natural gas deliveries from the Waha area to multiple mainline connections, Katy, Texas, and various US Gulf Coast markets.

On the Northeast side, production volumes were affected by several pipeline outages, resulting in a drop of almost 1 bcf per day. This has continued the stagnation of US dry gas production with output dipping to 99 bcf per day.

In response to this, Canadian imports, significantly lower when compared to 2022 flows, have increased; 1.1 bcf per day were added to imports from Tuesday, bringing Canadian-originated gas flows into the United States closer to levels seen in 2022. In addition, temperature outlooks remained largely unchanged, with the European model adding a few heating degree days and the American model trending slightly warmer.

Taken together, the weather, production, and maintenance issues could provide an inflection point to prices in a market still extremely lopsided in the favor of short-sellers or gas bears.

Weather in the northern United States from Sunday through Tuesday could produce showers and chilly overnight temperatures in the 20 and 30 Fahrenheit, forecaster NatGasWeather said in comments carried by industry portal naturagasintel.com.

Adds the forecaster:

“This should increase national demand to seasonal levels, but far from strong since the rest of the Lower 48 is expected to be ‘near perfect’, besides the hotter Southwest region.

After this northern U.S. system exits, the April 20-26 period is expected to again become comfortable over most of the U.S.,” NatGasWeather said, “with highs of 60s to 80s for light national demand.”

Houston-based energy markets advisory Gelber & Associates somewhat concurs with that theme in a note on natural gas issued Wednesday:

“Current forecasts suggest that there will be larger than normal storage builds in the coming weeks. The upcoming stretch of somewhat mild April temperatures could increase the surplus past the level it is already. Should warmer April temperatures keep gas demand light, the storage surplus to the 5 year average could reach as high as 400 bcf. As of now, gas in working storage is 321 bcf over the 5-year average and 442 Bcf over working gas in storage at this time last year.”

But as the spring season progresses towards summer, the demand situation could improve, Gelber said, adding:

“As we move into the summer and hotter summer temperatures come to fruition and increase power burn demand, we will start to see the muting of natural gas injections.”

Longer-dated futures of Europe’s benchmark prices have also rallied in recent weeks, indicating concerns about European gas supply for 2023/24 winter.

December futures have surged by 9% in the last two weeks over these concerns about refilling European storage ahead of next winter.

To this end, while 2022/2023 winter went better than anticipated, “the energy crisis is not over” for Europe, noted Gelber in a somber warning, adding:

“In a market with stronger competition from Asia for LNG supply, Europe may not be able to continue attracting spot cargoes and cannot rely on another warmer-than-usual winter and decreased competition from Asia as it prepares for the 2023/2024 winter.”

For the near-term though, gas prices could stay weak.

In Wednesday’s trade, front-month gas futures on the New York Mercantile Exchange’s Henry Hub were back to scraping the bottom of $2 per mmBtu, or million metric British thermal units, support. The session low was $2.072 versus an early week high of $2.245.

Technical charts for Henry Hub’s front-month May contract suggest another break beneath the $2 support before a return to middling $2 levels, said Sunil Kumar Dixit, chief technical strategist at SKCharting.com. He adds:

“We can see a further drop to the horizontal support zone of $2.02 and $1.97.”

Dixit said sustainability above the 5-Day Exponential Moving Average of $2.11 will resume the uptrend, which could face resistance again at the Daily Middle Bollinger Band of $2.21.

“Above this, the next upside potential is seen at $2.38 and $2.58.”

***

Disclaimer:  Enroll Here!

Enroll Here!