2 Red Hot Tech Stocks Primed for More Gains After Blowout Earnings

NDX

-1.73%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

-1.05%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

MSFT

-2.18%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CSCO

-1.48%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

JNPR

-2.22%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

META

-0.96%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

PANW

-1.12%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SKYY

-2.54%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ANET

-0.96%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

HACK

-1.53%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CIBR

-1.60%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

- Wall Street’s Q4 earnings season has all but wound down and it wasn’t as bad as everybody thought it would be.

- For the most part, companies have been successful in navigating through the challenging operating environment of rising interest rates, persistently high inflation, and a slowing economy.

- As such, I recommend buying shares in Palo Alto Networks and Arista Networks with more upside yet to come in the wake of their latest blowout results.

Wall Street’s fourth quarter earnings season has all but wound down, and with nearly 85% of S&P 500 companies having reported already, around 68% of those companies beat analyst expectations for the quarter. That’s a smaller share of companies surpassing expectations than the five-year historical average of 77%, according to FactSet.

The revenue performance during the Q4 reporting season has been slightly less positive: 65% of S&P 500 companies have delivered actual revenues above estimates, which is below the 5-year average of 69%.

Overall, despite some high-profile misses, I think everyone can agree that the Q4 earnings season wasn’t as bad as everybody thought it would be.

Taking that into account, I believe shares of Palo Alto Networks (NASDAQ:PANW) and Arista Networks (NYSE:ANET) are well worth considering in the wake of their latest blowout quarterly earnings reports. Both tech leaders still have plenty of room to grow their respective businesses, making them solid long-term investments.

Palo Alto Networks

- *Year-To-Date Performance: +34.2%

- *Market Cap: $57 Billion

Palo Alto Networks is widely considered as one of the leading names in the cybersecurity software industry. The Santa Clara, California-based tech company serves over 70,000 organizations in 150 countries, including 85 of the Fortune 100. Its core product is a platform that includes advanced firewalls and intrusion prevention systems which offer network security, cloud security, and endpoint protection.

Even with the recent uptrend in its share price, I anticipate PANW to extend its march higher in the coming months, considering the ongoing surge in cybersecurity spending from businesses and governments around the world.

PANW Daily Chart

PANW Daily Chart

Despite the current market turmoil, PANW stock ended Thursday’s session at a fresh high of $188.96, a level not seen since Sept. 12, 2022. At current valuations, the global cybersecurity leader has a market cap of $57 billion.

Shares have roared back in the early part of 2023 following last year’s steep selloff, gaining +34.2% year-to-date. In comparison, the ETFMG Prime Cyber Security ETF (NYSE:HACK) and the First Trust NASDAQ Cybersecurity ETF (NASDAQ:CIBR) are up ‘just’ +6.6% and +8%, respectively, over the same timeframe.

In a sign of how well its business has performed regardless of the current macroeconomic backdrop, Palo Alto Networks reported profit and sales which crushed expectations for its fiscal second quarter thanks to soaring demand for its various cloud-delivered security services.

The earnings and sales beat were fueled by a strong increase in total billings, a key sales growth metric, which surged 26% from a year earlier to $2.0 billion.

Palo Alto Networks CEO Nikesh Arora said in a statement:

“We continue to see our teams execute well in the midst of macroeconomic challenges, helping customers consolidate their security architectures.”

The cyber specialist also provided an upbeat outlook, lifting its annual guidance for operating profit, revenue, billings, and free cash flow margins due to favorable cybersecurity demand trends. Arora added on a post-earnings call:

«We’ve always maintained that we expect cybersecurity to be resilient, and we continue to see evidence of that.»

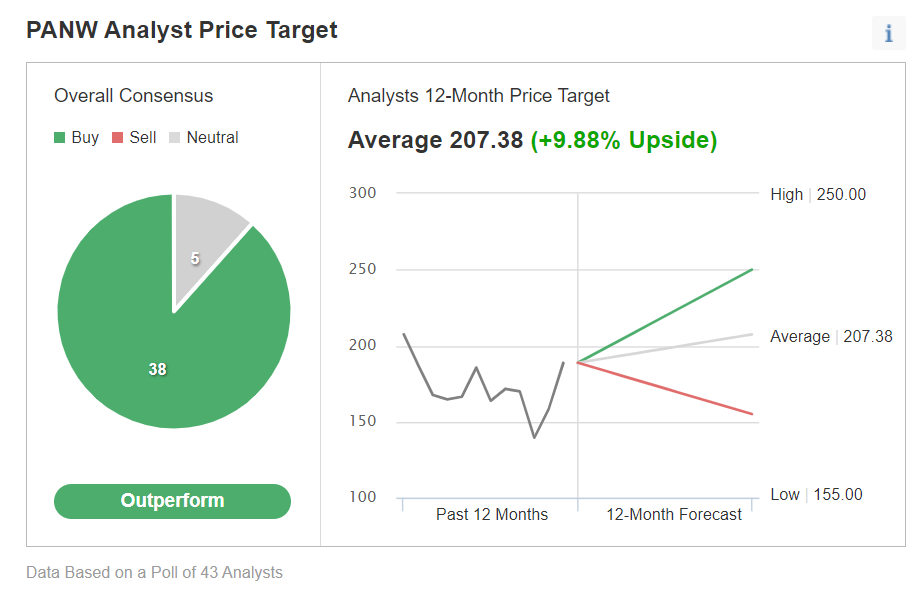

PANW Price Target

PANW Price Target

Not surprisingly, Wall Street remains optimistic on PANW, with 38 out of 43 analysts surveyed by rating the stock as a ‘buy’. Among those surveyed, shares had an upside potential of 9.9% from last night’s closing price.

Arista Networks

- *Year-To-Date Performance: +12.7%

- *Market Cap: $41.9 Billion

Arista Networks — which designs, produces and sells routers and other networking equipment to cloud providers and large datacenters — is one of the best tech stocks to currently own, in my opinion, as enterprises spend more on cloud migration despite the uncertain macro setting.

The Santa Clara, California-based networking-infrastructure company remains well placed to achieve ongoing profit and sales growth as the economy continues to undergo a sea change of digitization.

Arista, which sells switches that speed up communications among racks of computer servers packed into data centers, has been successful in grabbing market share from chief rivals Cisco Systems (NASDAQ:CSCO) and Juniper Networks (NYSE:JNPR) in recent years, a testament to strong execution across the company. It counts Microsoft (NASDAQ:MSFT) and Meta Platforms (NASDAQ:META) as its two largest customers. ANET Daily Chart

ANET Daily Chart

ANET stock closed at $136.84 on Thursday, not far from a recent 52-week high of $145.17 touched on Feb. 15, earning it a valuation of $41.9 billion.

Shares have run hot in recent weeks, with ANET scoring a gain of almost 13% so far in 2023 to outperform the comparable returns of the First Trust Cloud Computing ETF (NASDAQ:SKYY), which is up 10.5% year-to-date.

Arista Networks reported fourth-quarter earnings and revenue that easily beat analysts’ estimates, boosted by strong demand for its cloud computing network gear from large companies, government agencies and educational institutions.

For the three months ended Dec. 31, Arista delivered earnings per share of $1.41, surging 72% from EPS of $0.82 in the year-ago period. Revenue jumped 55% year-over-year to $1.28 billion, ahead of the Street consensus of $1.20 billion.

For all of 2022, Arista had sales of $4.38 billion, rising 48.6% from the previous year, with non-GAAP profits of $4.58 a share, up 59.6% from $2.87 a year earlier.

Jayshree Ullal, President and CEO of Arista Networks, stated:

“Despite having to navigate industry wide supply chain challenges, FY22 was a year of record performance exceeding expectations in growth, revenue and profitability.»

Looking ahead, Arista expects the good times to continue into its 2024 fiscal year, with management forecasting significant revenue growth amid the current operating environment.

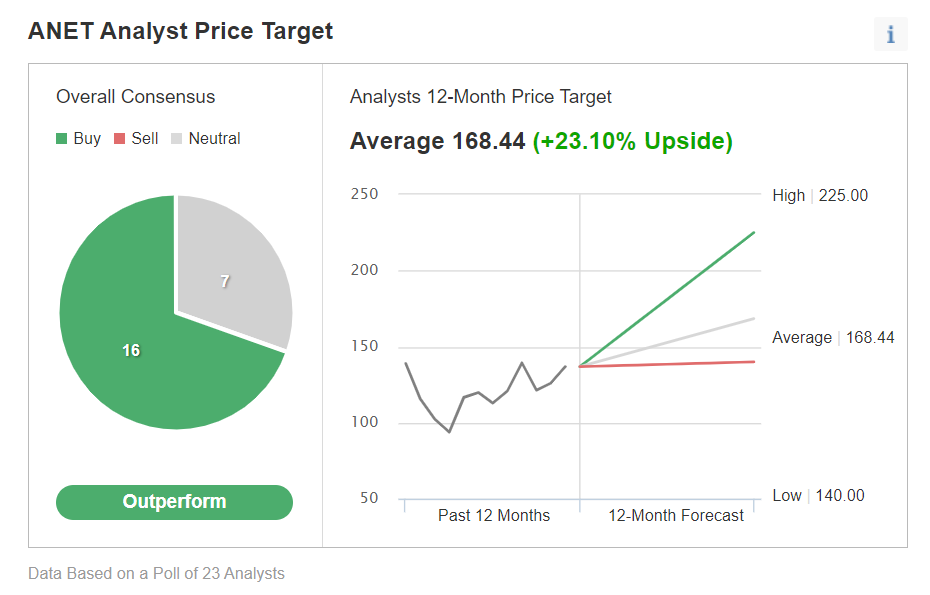

ANET Price Target

ANET Price Target

Wall Street has a long-term bullish view on ANET, as per an survey, which revealed that all 23 analysts covering the stock rated it as either a ‘buy’ or ‘neutral’. Shares have an average price target of around $169, representing an upside of 23.1% from current levels.

***