Will S&P 500 Break Above 5,000 Today?

NDX

+1.01%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

+0.57%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

META

-0.40%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

VIX

+0.00%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Stocks hit record highs as bears vanish, however, volatility looms.

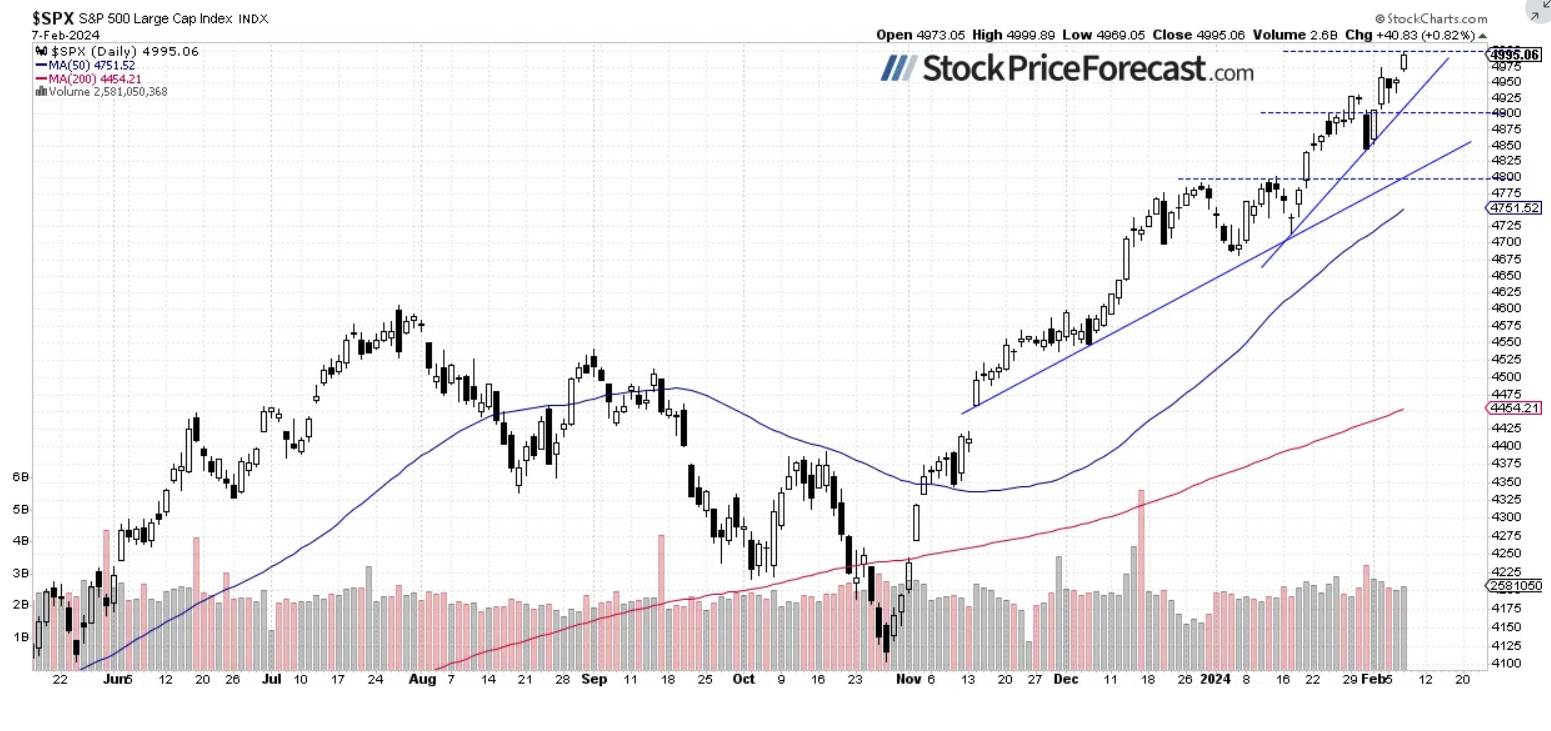

Stocks broke out of a short-term consolidation yesterday and reached new highs in a reaction to improving economic data and strong corporate earnings. The S&P 500 index set new record high at the level of 4,999.89, gaining 0.82% at the end of the day.

Recently, my short-term outlook was still neutral because the market seemed overbought and ready for a downward correction. When in doubt, it’s better to stay out of a position than to try to catch a top and open a short position too early.

Although a downward correction is widely expected, the overall market sentiment remains bullish, and the index may have another opportunity to reach new records above the psychologically significant 5,000 level. This morning, futures contracts indicate that stocks are likely to open 0.2% lower.

Investor sentiment remains very elevated; yesterday’s AAII Investor Sentiment Survey showed that 49.0% of individual investors are bullish, while only 22.6% of them are bearish. The AAII sentiment is a contrary indicator in the sense that highly bullish readings may suggest excessive complacency and a lack of fear in the market. Conversely, bearish readings are favorable for market upturns.

Last Tuesday, I wrote that The prediction proved correct until Thursday when the market began rallying again. However, today, the same statement remains very true, as the market still appears overbought in the short term.

Yesterday, I mentioned that

The S&P 500 is likely to retrace some of its yesterday’s breakout this morning; however, there have been no confirmed negative signals thus far. Yesterday, it broke above a short-term consolidation, as we can see on the daily chart. SPX-Daily Chart

SPX-Daily Chart

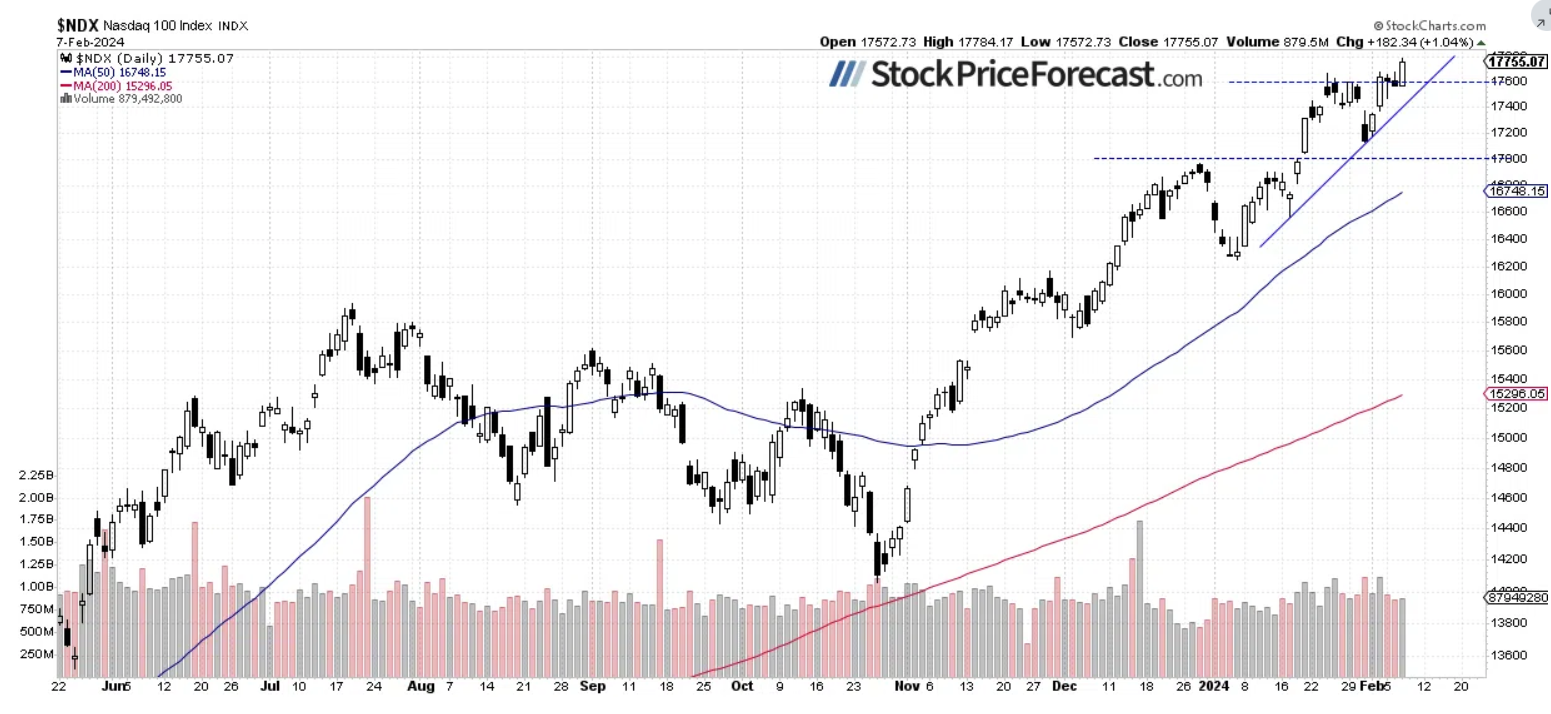

Nasdaq Hits New Record Too

The technology-focused Nasdaq 100 index reached a new all-time high at 17,784.17 yesterday. Recently, it has been relatively weaker than the broader stock market, but yesterday it caught up with the S&P 500. However, Nasdaq’s rally was led by a handful of “FANG” stocks like META (NASDAQ:META), NVDA and MSFT. Yesterday, I wrote about the NYSE FANG+ index. NDX-Daily Chart

NDX-Daily Chart

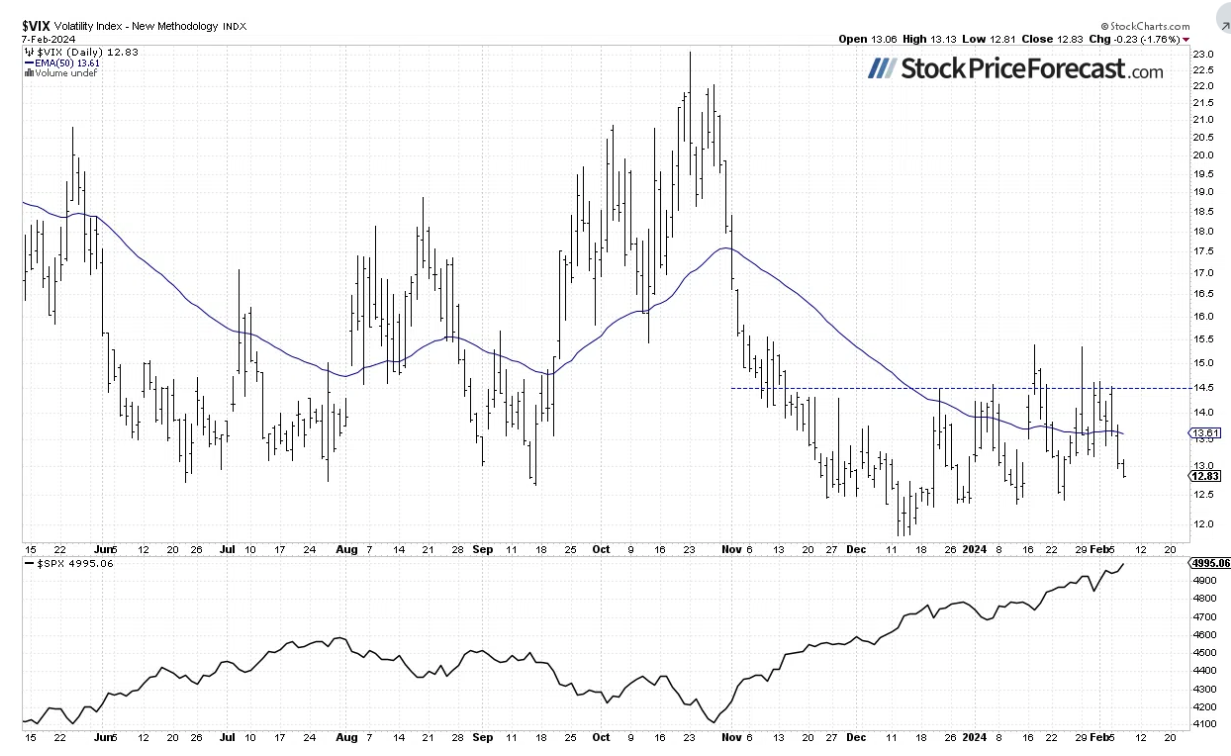

VIX Is Below 13

The VIX index, also known as the fear gauge, is derived from option prices. Yesterday, it fell below the 13 level, indicating a lack of fear in the market as stock prices reached record highs.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. VIX-Daily Chart

VIX-Daily Chart

Futures Contract Remains Above 5,000

Let’s take a look at the hourly chart of the S&P 500 futures contract. This morning, it’s trading above the 5,000 level. The resistance level is now at 5,020, while the support stands at 4,980, among others. S&P 500-Daily Chart

S&P 500-Daily Chart

Conclusion

Investor sentiment remains very bullish, with few bears in the market currently, as indicated by yesterday’s AAII Sentiment reading. Although the market is likely to open slightly lower today, the S&P 500 index may attempt to break above the 5,000 level, which it almost reached yesterday. However, in the short term, the possibility of a downward correction cannot be overlooked. A quick glance at the chart reveals that the S&P 500 index has recently become more volatile.

On December 21, I mentioned that , and indeed, there was a lot of uncertainty following the early-December rally and the breakout of the S&P 500 above the 4,700 level. However, the previous week’s price action left no illusions of a potential medium-term trend reversal. On Tuesday, I noted that This still holds true; Wednesday’s rout was very short-lived, as bulls came back with a vengeance on Thursday and Friday. Yesterday, the market rallied even further.

For now, my short-term outlook remains neutral.

Here’s the breakdown:

- The S&P 500 is expected to retrace some of yesterday’s gains, but there may be attempts to break above the 5,000 level.

- The market appears overbought in the short term, but no negative signals are evident.

- In my opinion, the short-term outlook is neutral.