Yen and gold power higher as new year kicks off

TSLA

+1.12%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

- Yen rallies on rumors BoJ might upgrade its inflation forecasts

- Gold edges higher as well, outlook for 2023 seems brighter

- ‘Buy everything’ mood in play as US dollar and stocks also gain

Yen capitalizes on BoJ speculation

The new year kicked off with a bang in financial markets, with rate-sensitive assets such as gold and the Japanese yen powering higher right out of the gates. It’s tempting to say investors are positioning defensively because they anticipate a stormy year ahead, but considering that liquidity remains in short supply, these moves are not necessarily trustworthy.

Any moves in an environment of thin liquidity are generally more ‘noise’ than ‘signal’. The absence of many traders means that markets can move without much news, and that any actual headlines can have a greater impact than usual.

This dynamic helped to boost the yen, following some reports that the Bank of Japan is considering raising its inflation forecasts at its meeting later this month. That would pave the way for further adjustments in its yield curve control strategy, allowing rate differentials to compress back in the yen’s favor.

Overall, a solid case can be made that the yen might be a winner in 2023, after a bruising 2022. Most of the factors that crushed the Japanese currency last year — monetary policy divergence, a trade shock driven by soaring energy prices, and a lack of tourism — have started to reverse. With risks around global growth intensifying as well, the yen’s safe haven qualities could also come back into play.

Gold gets its shine back

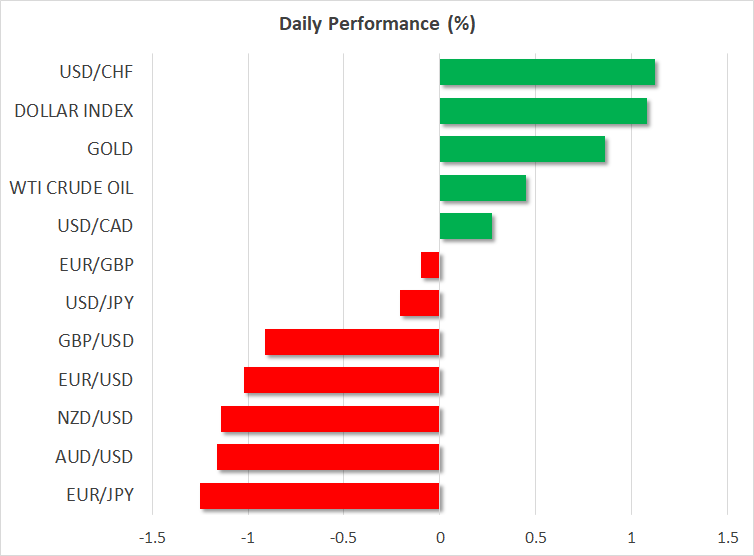

Gold prices started the year on the right foot, gaining almost 1% as trading got underway. Despite a sharp spike higher in the US dollar that is usually negative for the dollar-denominated metal, bullion still managed to edge higher, capitalizing on the retreat in real yields instead.

Beyond yields, seasonal elements might also be at play, as the period around the turn of the year is typically favorable for gold demand. Central bank purchases might be another factor, following reports last month that the People’s Bank of China has started to increase its gold reserves.

Drawing conclusions from short-term price action is not wise, especially so close to the beginning of the year. Still, looking into 2023, the prospects for gold seem brighter amid expectations for a less aggressive posture by central banks and concerns that the global economy could tip over.

‘Buy everything’ mood

Investors were in a ‘buy everything’ mode on the first proper trading session of the year, as the US dollar, bonds, gold, and futures tracking the main indices on Wall Street were all in the green. This is a strange combination, which might reflect yearly portfolio adjustments in a regime of scarce liquidity, not the real mood in investment circles.

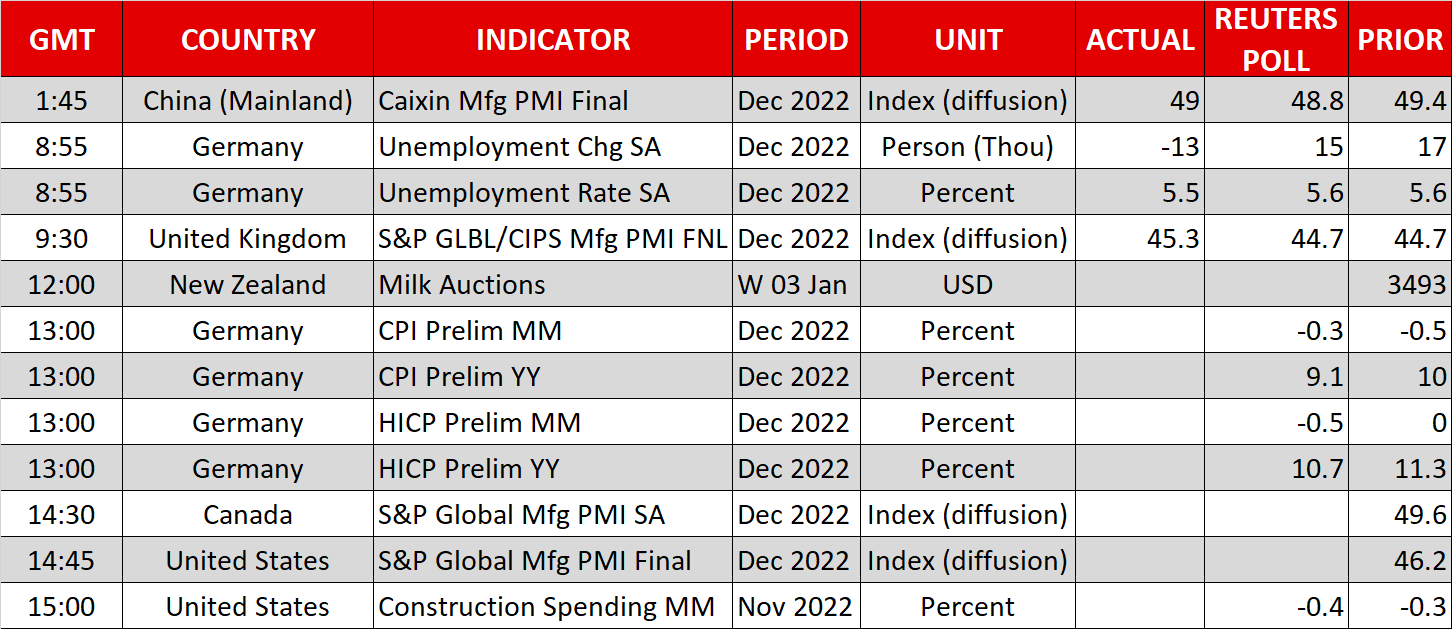

In the FX arena, the gains in the dollar and the yen translated into losses for other major currencies, with the Australian dollar and the euro drawing the short end of the stick. The selloff in the euro had a fundamental trigger, as Germany’s regional inflation prints pointed to a rapid slowdown in inflation that could make the ECB less trigger-happy on future rate increases.

US stock markets will reopen today after a long weekend. Futures point to gains of around 1%, even despite some news that Tesla (NASDAQ:TSLA) missed its quarterly car delivery targets. The automaker’s shares were down almost 4% in pre-market trading.

All told, the risk/reward for US equities remains unattractive. The S&P 500 is still trading at 17 times this year’s estimated earnings, which is expensive considering that those earnings are vulnerable to negative revisions, according to most leading economic indicators.